Uncategorized

Why Investing in Gold Is a Smart Move in 2024

As global economies fluctuate and financial markets face uncertainties, many investors are turning to precious metals like gold to secure their wealth. Gold has been valued for thousands of years, and its appeal only grows stronger in uncertain times. But why is gold such a reliable asset, and why should you consider it for your portfolio in 2024?

1. Gold as a Hedge Against Inflation

One of the main reasons investors flock to gold is its historical resilience against inflation. Unlike paper currency, gold’s value doesn’t degrade over time, making it a solid store of wealth. As the cost of goods rises, gold often retains or even increases in value, acting as a shield against inflation.

2. Global Demand and Supply Stability

Gold is mined all over the world and consistently in demand across industries—from jewelry to electronics. Its widespread use means it holds inherent value, making it less susceptible to regional economic fluctuations. This stability offers peace of mind for investors looking for a reliable long-term investment.

3. Global Portability and Security

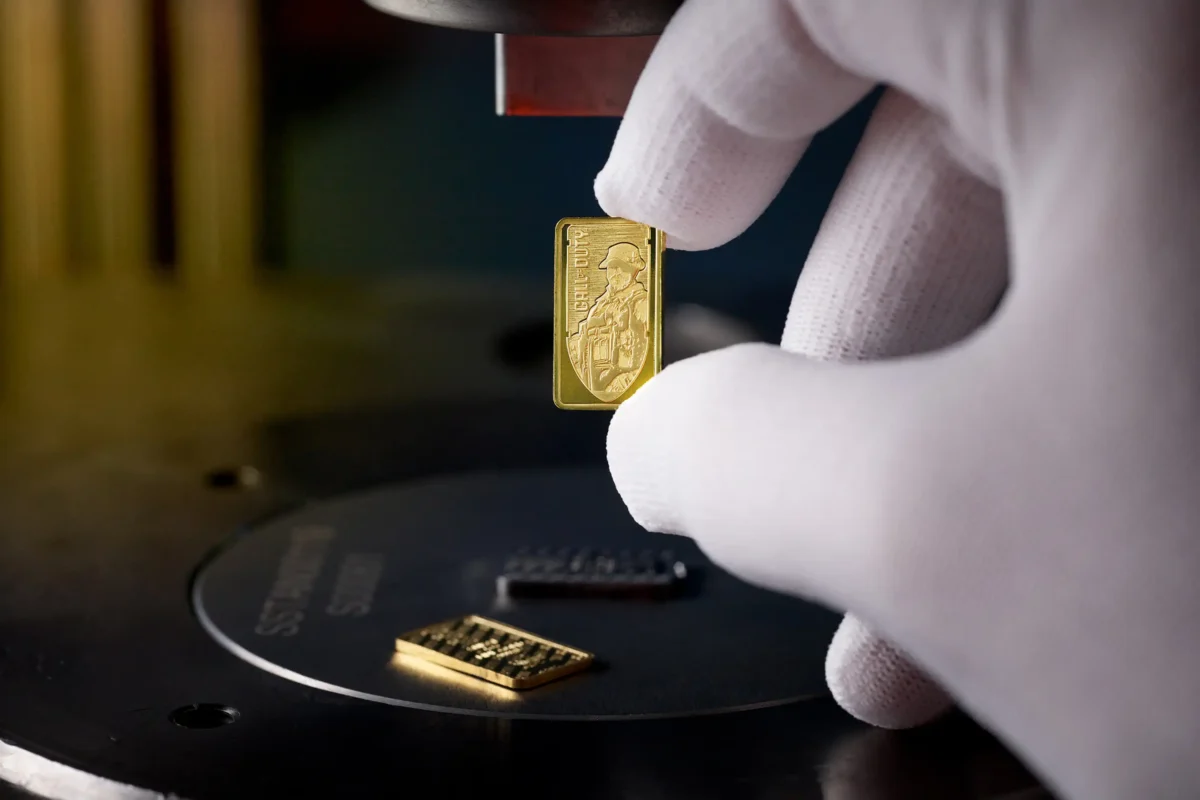

At GIF.Gold, we provide a selection of high-quality gold products, such as the iconic PAMP Fortuna bars, with insured and secure worldwide shipping. This portability allows you to safeguard your wealth no matter where you are, giving you access to a trusted investment with global appeal.

Investing in gold is more than just a financial decision; it’s a step toward building a stable financial future. Visit GIF.Gold today to explore our certified, pure gold products shipped securely to you anywhere in the world.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.